What is a GoodWill?

In short, it’s when you make a donation to children through a gift in your Will, but it’s also so much more than that – it’s about leaving behind a legacy that reflects you and your values and that shines kindness and generosity onto those who need it most – the world’s most vulnerable children.

Today, many children throughout the world are impacted by violence, hunger and poverty and have few of the protections that we often take for granted. A gift in your Will goes a long way to provide much-needed humanitarian and life-saving assistance to children in danger and offers them hope for a good future.

Rewrite a child’s future

Entrusting us with your legacy is a privilege that we take to heart. We know that your special gift will rewrite the future of many children’s lives and give them an opportunity for a brighter future. Your gift will be the same force for good that previous gifts were for people like Agamemnon Stefanatos some 70 years ago.

If you are interested in leaving a legacy gift, or learning how to make a Will, send an email to pauline@unicef.ie or fill out this form and we will be in touch shortly.

Start your legacy journey with UNICEF

A gift to UNICEF in your will is a gift for decades to come, helping UNICEF to save and protect children long into the future. You can request a legacy guide today by contacting our Legacy Gifts Manager, Pauline.

A future rewritten

Agamemnon’s Story

Agamemnon Stefanatos and was born in 1953, just 10 days after a massive earthquake had hit his native island of Cephalonia in Greece. The earthquake killed more than 1,000 people, leaving hundreds injured with almost every building destroyed.

Agamemnon’s mother was homeless and struggled to take care of her new baby son in the makeshift tents which were no protection from the cold and rain which followed the earthquake.

She became weak, ill, and unable to produce the milk needed to feed her baby. Because of the timely arrival of milk and clothes that UNICEF had shipped as part of its’ relief effort, Agamemnon survived.

Today he continues to live in Greece, runs a small hotel business and has two daughters which he is immensely proud of, and he is so thankful for the help he and his mother received in the aftermath of the quake.

For more info on how you can help save lives through a legacy gift, send Pauline an email pauline@unicef.ie or fill out the form above and we’ll be in touch shortly.

More children die from dirty water than bullets

By leaving a legacy in your will, you can help families like Nabil's, a father in Yemen whose son caught cholera from unsafe water.

Contact Pauline today about leaving a Legacy Gift in your Will

"*" indicates required fields

Why Leave a Gift in My Will to UNICEF?

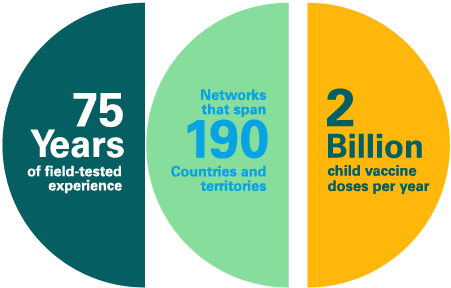

UNICEF brings over 75 years of field-tested experience with networks that span 190 countries and territories. We are impartial and non-political, but we are never neutral when it comes to protecting children’s rights. What matters to us is reaching every child in need, protecting their rights to survive, thrive and reach their full potential.

We are funded entirely by voluntary contributions and by leveraging our infrastructure, economies of scale and expertise our global reach is truly unique. In terms of vaccines alone, UNICEF delivers over 2 billion vaccines doses each year, reaching 45% of the world’s children under five.

What Information Does My Solicitor/Executor Need to Have a Gift Included in My Will?

Our organisation details are as follows:

Our Charity Name: UNICEF Ireland

Our Registered Charity Number: 20008727

Our Revenue: CHY NO. 5616

Our Registered Offices are: 33 Lower Ormond Quay, Dublin 1

If you are an Executor/Solicitor and need our details to arrange a transfer of funds, or need to discuss any aspect of the gift, please contact our Gifts in Wills Manager – Pauline Murphy

Tel: 01 878 3000

Below is suggested wording and legacy gift options which you could choose when including UNICEF Ireland in your will:

“I give to UNICEF Ireland, 33 Ormond Quay, Dublin 1, registered charity RCN 20008727 and CHY 5616” {insert in figures and words from the list below} and I direct that my bequest be used for its charitable purposes.”

a. All (or a percentage share of) the residue of my estate

b. A specific item/shares or my property known as (name of property) and situated at (location of property)

c. The sum of (amount in figures and in words)

How Will UNICEF Manage My Legacy Gift?

Choosing to leave a gift in your Will brings comfort in knowing that your values will live on. In choosing to leave a gift to UNICEF, you are making a promise to be there for vulnerable children around the world. In respecting that decision, we make the following promises to you so you can be certain of what to expect from us.

- We promise to use your gift wisely so that it has the greatest impact in providing for vulnerable children around the world.

- We recognise that your loved ones; family and friends come first and we promise to treat them with the utmost respect, sensitivity and courtesy at all times.

- Leaving a legacy is a private and personal decision and yours alone. We will never pressure you in anyway and respect your right to change it at any time in the future.

- You don’t need to tell us that you have chosen to leave a gift in your Will, but if you do so, we would love to thank you and keep you updated about our work and include you in any events of interest to you.

- We are always happy to talk to you about your gift or answer any questions you may have about UNICEF’s work. You can speak to our Executive Director – Peter Power and learn about our future plans or reach out to our Gifts in Wills Manager- Pauline – 01 878 3000

Are There Tax Implications If I Leave a Gift to Charity?

Legacy gifts to charity are completely tax free and will help reduce the tax payable on your estate.

Seek advice from your Solicitor or Financial Advisor regarding all tax implications when making a Will.

Who Can I Talk with to Learn More About Leaving a Gift in My Will?

You can talk in confidence to our Legacy Manager, Pauline on 01 – 8783000 or email pauline@unicef.ie

Pauline will expertly explain how to make a Will, and discuss the various free will-writing services available to our supporters.

It doesn’t take a fortune to change their fortune

Gifts of all sizes can have a monumental impact on the life of a vulnerable child

I didn’t have dependents when creating my Will – UNICEF is well respected, professional and they do extremely valuable work so that was my reason.

- GoodWill Legacy Donor

Learn more about Gifts in Wills

Contact Pauline to learn more

You can talk in confidence to our Legacy Gifts Manager, Pauline who will help guide you in writing your Will and send you information on our Legacy Giving programme.

Phone: 01 878 3000

Email: pauline@unicef.ie